What we learned from Prime Day 2024

Posted on: July 26th 2024What the data told us about shopping

At a glance 🤔

Overall, our clients on prime day saw an average lift of 5-7x in daily sales of the last 30 days on Day 1 and 4-6x on Day 2. Our best performing clients had 10x to even 30x.

An even split ⚖️

While Prime Day 1 was a bigger day, Prime Day 2 was not far behind: 5.7x vs. 4.7x. Consumers have learned that this is a two-day event (thanks, Megan Thee Stallion!), which means they’re spreading out shopping sessions more evenly across both two days.

Beauty, supplements, and skincare on the rise 💄

Our best performing categories in terms of 2-day lift were Beauty (6-9x), and Supplements (5-7x). Specifically, skincare has been trending upward in search volume all year, thanks to TikTok’s ongoing influence with driving cosmetic and personal care trends forward, and creating a trickle down to buying on Amazon.

The celebrity bump 👊

Celebrity or influencer-backed brands were up 8-11x (even 30x in some cases). Something we we realized was when someone with a large audience or following posted at the start of Day 1, this gave the brand a head start in leading their category through the full day.

Discounting magic 🪄

Brands that discounted just 20% or less (the average required discount for many promo types) saw sales lift of about 4x across the two Prime Days.

On the other hand, brands who discounted 30% or more saw a 6.6x average lift. Clearly there was an element of “standing out against the crowd.”

Put it on repeat 🔁

Our data backed up Amazon pushing repeat purchases in their changes to merchandising (vs. discovery of new products). Our lift in consumables on average was far greater than in years past.

Conversion rates also increased across almost every category, a 45% increase, which pointed to one thing: Prime Day shoppers clearly have a high intent to buy.

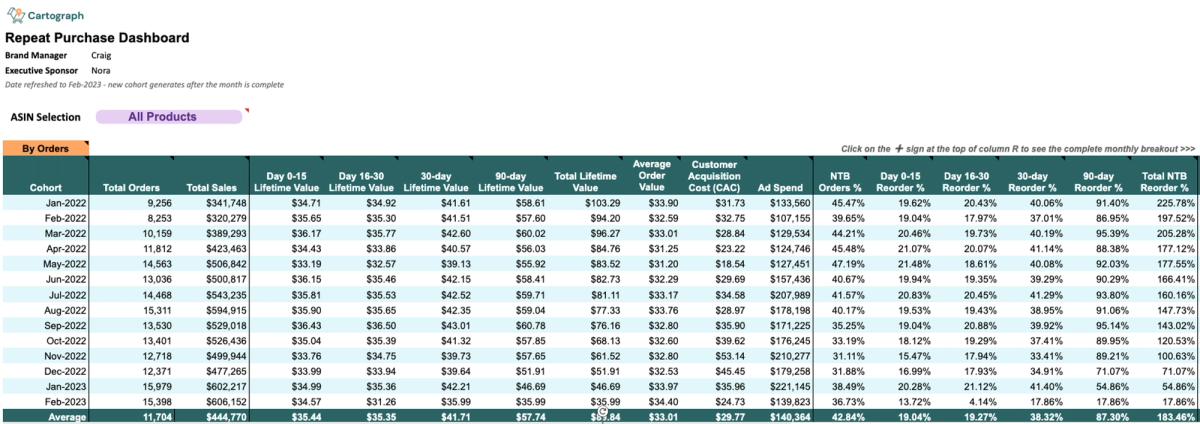

Note: The chart below is a repeat purchase dashboard for our clients.

General observations

Everything was RED 📕

This year, Amazon had red badges everywhere to signal what was a Prime Day deal or not. These red badges flashed around in not only search results, but all over. My favorites were in Sponsored Brand Banners on top of search and Sponsored Brand Videos in search.

This was a big change from last year, when there were different badges that indicated bigger deals and discounts. These were broken all over the place, and it was obvious when brands had their deals working or not.

I think this contributed a lot to the “Prime Day deals are fake / not good” this year that trended on social: even small discounts got the big red badges.

Evergreen deals 🌲

Deals were evergreen and less urgent, which tracks more closely how deals (e.g., BFCM) have trended within Shopify’s ecosystem lately. In the past, Prime Day focused on time-bound deals: Each had a timer and would only be available for a limited time within the 48-hour Prime Day window.

Now, most deals are available for the duration of the event. It seems like Amazon thinks there’s much less need to create urgency.

Has the lightning deal fallen from grace?

More creativity 🎨

We saw a number of sellers pushing boundaries with ads and creative assets, especially with top banners and branded videos; they really stand out!

Technical difficulties 🛠️

Amazon’s advertising console was down for over an hour in the evening on Day 1.

Brands experienced several strange, new suppressions that prevented them from running coupons or promos, and Prime Day badging displayed somewhat inconsistently, causing confusion for shoppers (and frustration for brands!).

The general Amazon community was up in arms on LinkedIn with these issues, which felt more than normal.

Were the deals “fake”? 💹

I got questions about price increases ahead of Prime Day, which has the impression of making the deals seem “fake”. (I think this is trending on Tiktok and social). I think it was most prevalent in categories like electronics.

This definitely exists, though it’s not so simple to pull off: requires months of planning. “Reference price” is closely monitored and if it moves ahead of Prime Day, you often have to recreate your deals or restructure.

But - per my “everything was red” post above - Amazon maybe loosened the reins.

In our categories we actually worried about June or July deals or price matching which would make your reference price too *low*, requiring too deep of a discount brands couldn’t afford.

What we learned

Stretch your budget across the full two days 📺

Many Amazon sellers exhaust their ad budgets early, which is understandable given how much action happens at the beginning (i.e. the morning of Day 1).

But that’s also where competition and CPC are at their peak. Instead, it’s best to pace your budget throughout the second half of Day 1 and all of Day 2. PPC ad costs often significantly decrease during this period, which is great for grabbing customer share at a lower cost.

Our teams noted spikes in sales in the evening on both days. Adjusting bids (using Amazon’s dayparting) is table stakes for a solid Prime Day strategy.

Amazon pushed heavy on repurchase behavior ♻️

From “Buy It Again” brand deals high on the homepage to 50% S&S coupons being everywhere, Amazon really emphasized the familiarity of previous purchases to get customer buy-in.

Though Prime Day definitely focuses on electronics and devices, consumables are increasing in importance.

Early bird gets the worm 🌅

Brands that begin around 7am PT / 10am ET secured an early lead on sales and often exceeded their competitors' sales for the remainder of Prime Day.

We saw great effects when influencer, social, or Off-Amazon support was used early in the day. Pushing from multiple marketing angles (email, social, etc.) is a great approach for taking an early and sustained lead throughout Days 1 and 2.

Don’t underestimate the power of FOMO: the evening slot with an email or SMS push was a big winner for some brands. People are scrolling in bed, afraid of missing the savings. What a world.

Price matching has gotten crazy 🏷️

Chewy and Target have started price-matching promos or sale prices, which can jeopardize your deals on Prime Day, where Amazon requires a price discount. Overall, price matching is just getting worse.

It’s becoming very common to create unique product offerings for each eCommerce platform. This not only helps price matching and resellers, but lets brands offer more competitive value with better economics.

Where to go from here

You’ve made it through the madness. But what do you do from here?

The next 2 weeks are critical for your business.The whole purpose of Prime Day is new customer acquisition, so you should have a post-Prime Day plan in place to ensure you don’t lose them.

Brands in our portfolio sold roughly 5-10x normal daily sales on the Prime Days. Generally you can multiply that by 10 for total page visits. That means on these two days you likely got over 100x a normal day in traffic. And most of those were people being exposed to your brand for the first time!

Here are some ways you can accomplish that:

1. Launch follow-on promos for customers still in cart

2. Email, text, and post about the follow-on promos (”Did you miss it?” FOMO is strong!)

3. Target new people who visited your pages with retargeting ads

4. Put your new buyers into repurchase campaigns and target them separately: they’re a different audience than your normal buyers, and you should measure performance

You want to do anything within reason that keeps you top-of-mind so you don’t lose them.

PS – not sure if your Prime Day was good?

Look at your Best Seller Ranking compared to your direct competitors.

It’s the easiest way to measure relative performance!

We like tools like Keepa or Helium10 to track both this and price (plus - you can see if any brands pulled price increase tricks!).

Thanks for following along!